Money Doesn't Have to Be Mysterious

Most people find financial planning overwhelming because they're handed complex spreadsheets and industry jargon. We take a different approach—breaking down the fundamentals into practical steps that actually make sense in your daily life.

View Learning Options

Three Pillars You Can't Skip

After working with hundreds of Australians over the past decade, I've noticed the same gaps appearing again and again. These aren't optional—they're the foundation everything else builds on.

Understanding Your Numbers

Before you can plan anything, you need to know where you actually stand. Not just your bank balance—your complete financial picture including debts, assets, and those recurring expenses you've forgotten about.

Creating Realistic Buffers

Emergency funds sound boring until you need one. The goal isn't some impossible savings target—it's building a cushion that fits your actual circumstances and gives you breathing room when things go sideways.

Planning Beyond Next Week

Most people think in monthly cycles because that's when bills arrive. But meaningful financial progress requires thinking in years, not pay cycles. This shift in perspective changes everything.

A Step-by-Step Approach That Works

Financial planning isn't something you do once and forget. It's an ongoing process that adapts as your life changes. Here's how we help people build sustainable habits.

Map Your Current Reality

We start by documenting everything—income sources, fixed expenses, variable costs, debts, and assets. This isn't about judgment. It's about clarity. You can't navigate without knowing your starting point.

Identify Your Pressure Points

Every financial situation has weak spots. Maybe it's high-interest debt eating your income, or irregular cash flow creating stress. We pinpoint these vulnerabilities so you can address them systematically rather than reacting to crises.

Build Your Framework

Once you understand where you are and what needs attention, you create a framework—not a rigid budget, but a flexible structure that guides decisions without feeling restrictive. This is where theory meets your actual life.

Monitor and Adjust

Life changes. Income fluctuates. Unexpected expenses appear. Your financial approach needs to accommodate this reality. We teach you how to review and adjust your framework quarterly so it stays relevant to your circumstances.

What This Actually Looks Like

Our programs run from September 2025 through March 2026, giving you time to implement strategies gradually rather than overwhelming yourself with massive changes overnight.

You'll work through real scenarios—not hypothetical textbook examples. We use case studies from actual clients (anonymized, obviously) so you can see how different approaches play out in practice.

And look, I'm not going to promise you'll retire early or become wealthy. What you will get is a clearer understanding of how money works, practical tools you can use immediately, and realistic strategies that fit your life.

Learn About Our Approach

"The biggest mistake I see is people waiting until they 'have enough money' to start planning. Financial planning isn't about how much you have—it's about what you do with whatever amount you're working with."

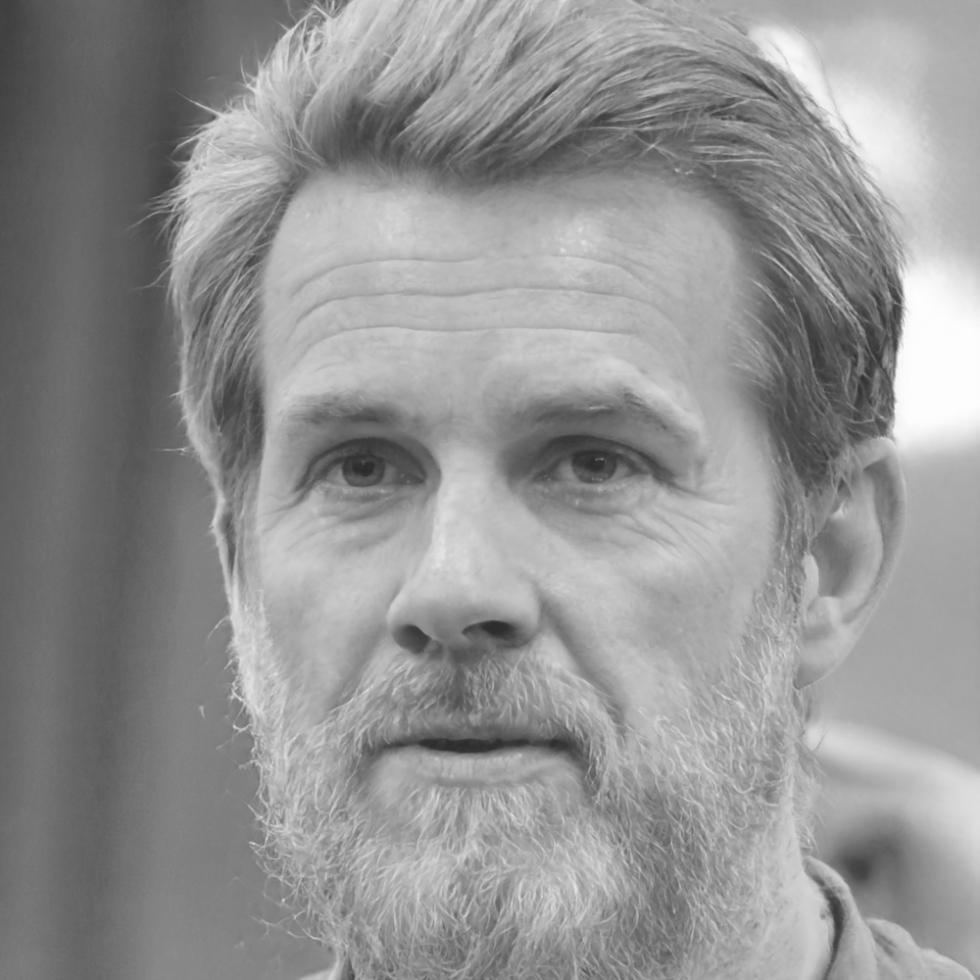

Callum Thorne

Financial Education Specialist, lumythenora

Why We Do This

I spent years in traditional financial services before realizing most educational content was either too simplified to be useful or so complex it intimidated people into inaction. There had to be a middle ground.

lumythenora was founded in 2018 specifically to fill this gap. We're based in Baulkham Hills, serving people across Australia who want practical financial education without the sales pitch. Our focus is teaching skills, not selling products.

If you're ready to stop feeling confused about money and start making informed decisions, we'd be glad to help. Get in touch through our contact page or check out the FAQ section for more details about how our programs work.